will i get a tax refund if i receive unemployment

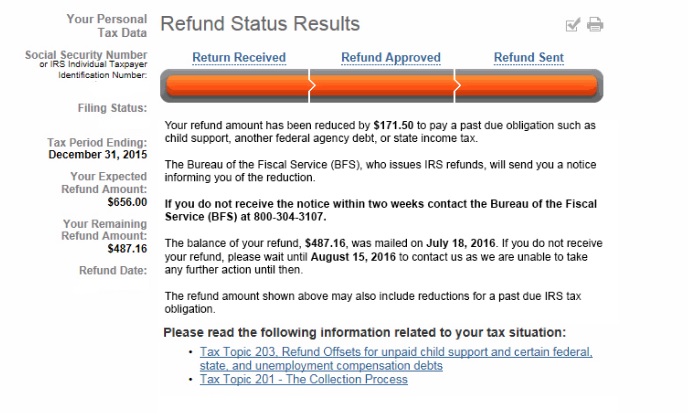

Heres a list of reasons your income tax refund might be delayed. You will get the additional refund if all of the following are true.

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

. If your state conformed with the federal unemployment insurance compensation tax exclusion you may need to file an. If you filed taxes earlier this year and paid on unemployment benefits you received in 2020 then you might be owed a refund by the IRS. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

How do I file taxes with unemployment. People might get a refund if they filed their returns. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in.

The IRS announced a couple weeks ago that millions of Americans who were on unemployment in 2020 would be receiving refunds on their 2020 taxes thanks to the. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. For some there will be no change.

The tax agency has confirmed it is sending. If youve paid too much during the year youll get money back as a tax refund. Tax refunds on unemployment benefits to start in May.

People who received unemployment benefits last year and filed tax. It might take several months to get it. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Unemployment benefits are taxable income so recipients must file a Federal tax return and pay taxes on those benefits. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to. Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts.

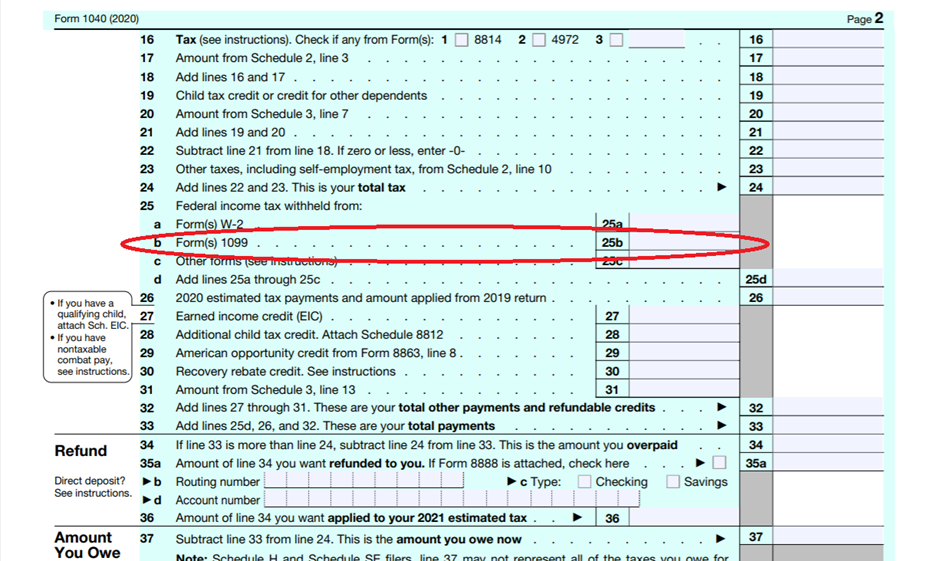

You filed for the earned income tax credit or additional child tax credit. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Updated June 1 2021.

Your tax return has errors. Reporting unemployment benefits on your tax return You report your unemployment compensation on Schedule 1 of your federal tax. Depending on your circumstances you may receive a.

As a result of changes introduced by the American Rescue Plan Americans who have received unemployment compensation no longer have to pay income taxes on the first. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer. Generally you have up to three years to file an amended return.

Forms you receive When you have unemployment income your state will send you Form 1099-G at. You reported unemployment benefits as income on your 2020 tax return on.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch

If I Paid Taxes On Unemployment Will I Get A Refund

Do You Know Your Unemployment Benefits Independent Contractor Tax Advisors

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

/https://static.texastribune.org/media/files/8f76598691a5256e24b6c7cf4a44b760/S%20unemployment%20determination%20TT%2002.jpg)

Texas Unemployment Tips And A Guide For Navigating A Confusing System The Texas Tribune

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Irs Unemployment Refunds Moneyunder30

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Here S What You Need To Know

Tax Refund Offsets Where S My Refund Tax News Information

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Unemployment Benefits Tax Refund Will You Receive One Waters Hardy And Co P C

Tax Day 2021 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

Year End Tax Information Applicants Unemployment Insurance Minnesota

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun